Passenger traffic further decelerates in November at +1.7%

17 January 2020Brussels - European airport trade body ACI EUROPE today released its latest air traffic report for November 2019, measuring all commercial aviation air services from full service, regional, low cost and charter.

Passenger traffic across the European airport network grew by +1.7% - marking a further deceleration over the preceding months. Meanwhile, the drop in freight traffic somewhat eased at -0.3%, thanks to a sharp increase in freight volumes at non-EU airports. Aircraft movements decreased for the second month in a row at -2.3% (-0.5% in October).

Olivier Jankovec, Director General of ACI EUROPE commented: “The deceleration of passenger traffic at Europe’s airports is mainly focused on the EU market – and it reflects both supply and demand pressures building up. Airlines bankruptcies have resulted in capacity being taken out of the market, along with airlines generally limiting their growth due to a focus on yields & risk aversion as well as the continued grounding of the 737MAX. Industrial action notably in Germany only added to these pressures in November.”

He added: “The going is progressively getting tougher across the airport industry – especially for smaller regional airports. 55% of them lost traffic in November, compared to 39% for the rest of the industry. The current difficulties of Flybe - Europe’s largest regional airline – both underline the fragility of regional air connectivity and the vital role it plays for cohesion given that other transport modes very often do not provide viable alternatives.”

NON-EU MARKET IN THE DRIVING SEAT

Passenger traffic at non-EU airports increased by +3.2% at non-EU airports in November.

The month brought double-digit increases at airports in North Macedonia, Serbia, Ukraine, Belarus, Albania, Israel and Armenia – as well as more moderate growth at those in Bosnia & Herzegovina, Montenegro, Moldova, Turkey and Russia. Accordingly, the best performers amongst capital & larger non-EU airports came from: Skopje (+15.3%), Belgrade (+14.6%), Kyiv KBP (+14.4%), Moscow VKO (+13.2%), Tel Aviv (+13.1%), Antalya (+10.9%), Istanbul SAW (+10.2%) and Yerevan (+10%).

At the other of the spectrum, passenger traffic kept falling sharply in Iceland (-30.8%) due to the fallout of the collapse of WOW and other airlines’ capacity adjustments. Airports in Georgia (-6.2%) and Norway (-2.6%) also experienced declining volumes, while Swiss airports reported flat growth (+0.1%).

SUBDUED GROWTH ACROSS THE EU MARKET

Passenger traffic at EU airports increased by +1.3% in November – a sharp contrast with growth registered last year for the same month (+6.7%).

Hungary, Poland, Croatia and Luxembourg were the only EU markets where airports achieved double-digit growth, while those in Portugal, Austria, Bulgaria, Romania, the Czech Republic, the Baltic States, Cyprus and Malta grew at a lower but still dynamic pace (above 6%).

Conversely, airports in Slovenia, Sweden, Slovakia, Germany, Denmark, the UK and Ireland saw passenger traffic declining – and those in Greece, the Netherlands and Finland registered only marginal gains. The demise of Aigle Azur, XL Airways, Adria Airways and Thomas Cook in September 2019 especially hit Ljubljana (-27%), East Midlands (-10.3%), Glasgow (-6.1%), Paris-Orly (-4.7%) and Birmingham (-1.6%).

Amongst capital and larger EU airports, the following ones posted the best results: Budapest (+14.4%), Warsaw (+13.4%), Luxembourg (+11%), Vienna (+9.1%), Lisbon (+9.4%) and Malta (+8.3%).

MAJORS IN LINE WITH INDUSTRY AVERAGE & SMALLER REGIONALS UNDERPERFORMING

Passenger traffic at the Majors (top 5 European airports) stood at +1.7% - exactly the European average. Istanbul geared up with +6.5% growth, followed by Paris-CDG (+3.3%) and London-Heathrow (+2.0%). Amsterdam-Schiphol (+0.3%) and Frankfurt (-3.4%) underperformed, with the latter being hit by strikes at Lufthansa.

Meanwhile, smaller regional airports (less than 5 million passengers) continued a negative trend, with a decrease in passenger traffic of -0.9%. Amongst smaller regional airports, the highest increases came from: Dubrovnik (+113.9.7%), Mostar (+63.3%), Nis (+58.8%), Kharkiv (+58.5%), Kutaisi (+50.5%) and Zadar (+46.4%). Amongst larger ones (more than 5 million passengers), Krakow (+23.9%), Bordeaux (+17.6%), Nantes (+12.9%), Sochi (+12.7%) and Marseille (+10%) came on top.

FREIGHT RESULTS REINED IN BY THE EU MARKET

As in preceding months, the downturn in freight traffic in November remained focused on EU airports (-2.0%), with non-EU airports posting a robust increase (+9%).

Out of the top 10 European airports for freight, only 3 saw their traffic increasing: Madrid-Barajas (+13.5%), Luxembourg (+5.5%) and Liège (+5.1%).

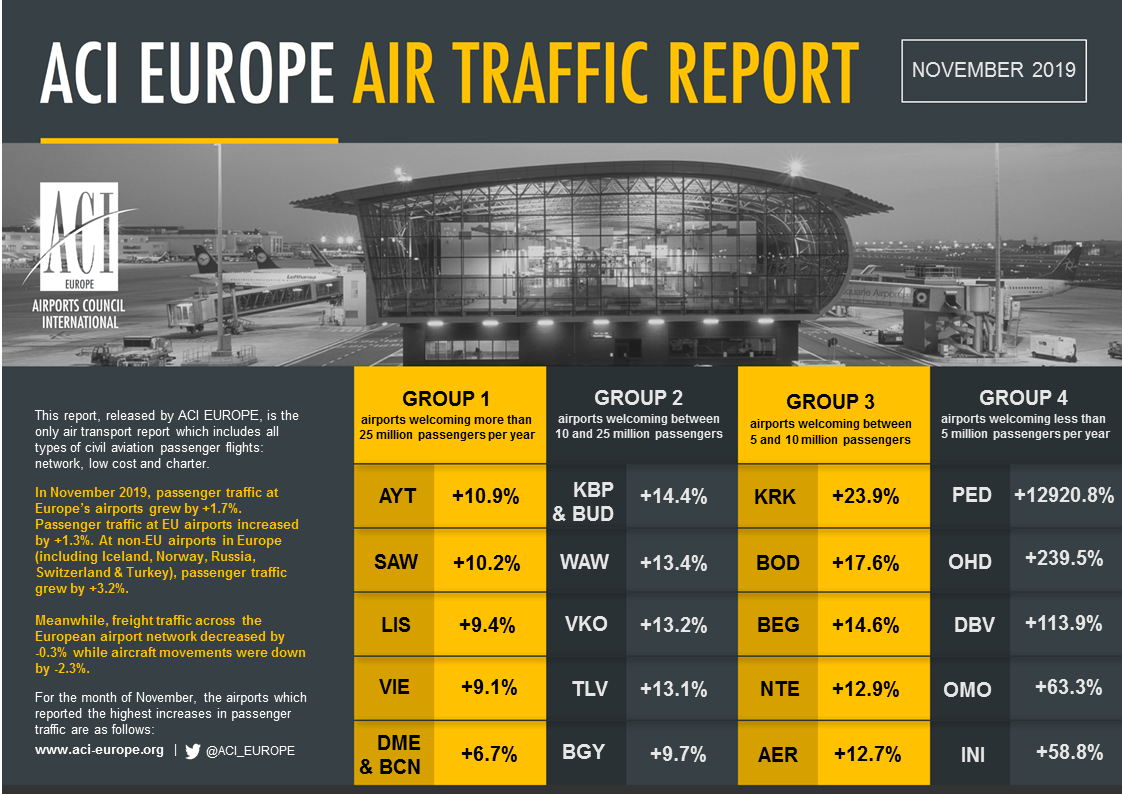

During November, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +1.3%, +2.4%, +3.1% and +0.3%.

The airports that reported the highest increases in passenger traffic during October are as follows:

GROUP 1: Antalya (+10.9%), Istanbul SAW (+10.2%), Lisbon (+9.4%), Vienna (+9.1%), Moscow DME & Barcelona (+6.7%)

GROUP 2: Kyiv KBP & Budapest BUD (+14.4%), Warsaw (+13.4%), Moscow VKO (+13.2%), Tel-Aviv (+13.1%), Milan BGY (+9.7%)

GROUP 3: Krakow (+23.9%), Bordeaux (+17.6%), Belgrade (+14.6%), Nantes (+12.9%) and Sochi (+12.7%)

GROUP 4: Pardubice (+12920.8%), Ohrid (+239.5%), Dubrovnik (+113.9%), Mostar (+63.3%) and Nis (+58.8%)