European air fares rising way above inflation and airport charges

14 November 2023

14 November 2023

Brussels: ACI EUROPE today rebutted claims made by IATA that the increase in air fares in Europe is well below inflation while airport charges would have increased much above it.

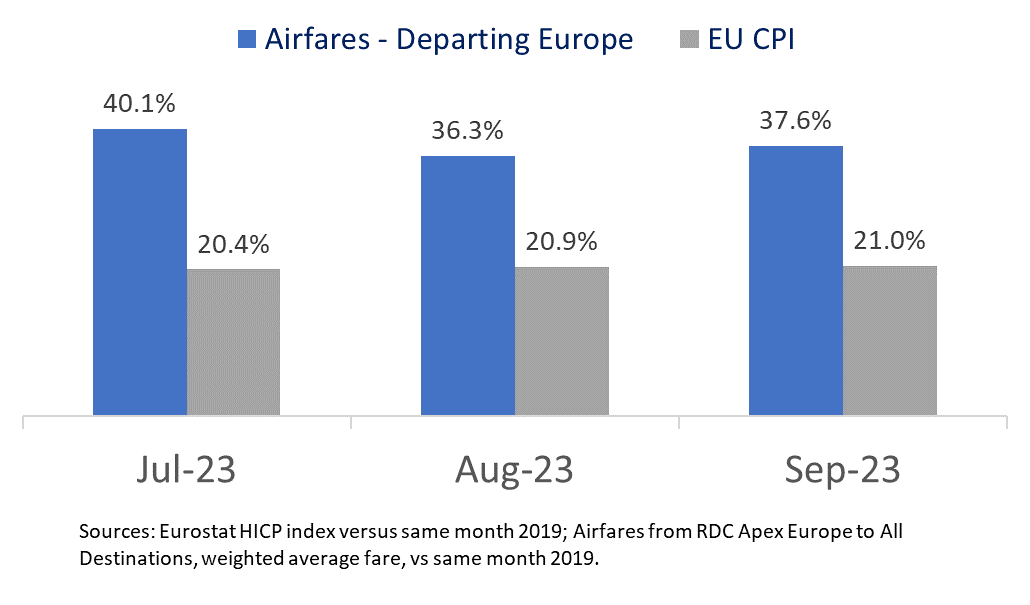

While IATA states that air fares in Europe only increased by +16% as of June this year compared to 2019, independent and authoritative data from RDC1 shows such increase actually standing at +38% over the peak Summer months (Q3) - nearly two times the increase in the average consumer prices index (+20.8%2). October confirmed this trend with air fares even increasing further at +47% when booked 3 months in advance.

IATA’s assertion that airport charges have been continuously increasing above inflation also does not stand scrutiny – as it relies on flawed data from just 2 airports3. In fact, airport charges in Europe this year have increased by +13.6%4, far below inflationary pressures hitting airports, let alone air fares.

IATA’s assertion that airport charges have been continuously increasing above inflation also does not stand scrutiny – as it relies on flawed data from just 2 airports3. In fact, airport charges in Europe this year have increased by +13.6%4, far below inflationary pressures hitting airports, let alone air fares.

Olivier Jankovec, Director General of ACI EUROPE said: “Confronted with inaccurate and misleading data, it is crucial to set the record straight about how air fares and airport charges have actually evolved. Not only have airlines been able to reflect inflationary pressures in what they charge consumers, but they have been able to exert significant pricing power thanks to supply pressures and capacity discipline. Good for them! Conversely, many airports have yet to fully reflect inflationary pressures in their user charges, with regulators often oblivious of these pressures and of how debt accumulated through COVID is hurting their investment capabilities.”

Beyond that, it is also puzzling to hear IATA asserting that the recovery of the European aviation market is bringing even more competitive conditions, with more airlines and more routes to choose from. The reality is that air connectivity has recovered at a slower pace than passenger volumes. As of June, air connectivity from European airports remained -17% below pre-pandemic (2019)5 levels, while passenger traffic was at -5.9%.

Jankovec noted, “This means that in addition to paying much inflated air fares, consumers tended to have fewer options to choose from. I am sure this is something many Europeans reckon with and have experienced first-hand this Summer.”

He concluded: “The market has structurally changed through the pandemic and the recovery, and it is crucial that policy makers and regulators now see though these changes and what lies ahead. In particular, the acceleration of airline consolidation coupled with airports reaching capacity limits will challenge our Single European aviation market and air connectivity developments. This is where economic regulators should step back, as the dominance of airlines today makes intrusive price regulation of airports obsolete. This is also where the 30-year-old EU regulation on airport slots requires urgent review.”