Latest traffic data shows disastrous COVID-19 impact on airport industry

7 August 2020

7 August 2020

European airport trade body, ACI EUROPE, today released its air traffic report for June, Q2 & H1 as well as an interim update for July.

The report reveals the devastating impact of the COVID-19 pandemic on Europe’s airports, with passenger traffic decreasing by -64.2% during the first half of the year - and almost coming to complete standstill in the second Quarter, with a drop of -96.4% compared to the same period in 2019.

NON-EU AIRPORTS LESS IMPACTED THANKS TO DOMESTIC TRAFFIC

Over the first half of the year, the decrease in passenger traffic was slightly less pronounced in the non-EU market (-59.8%) than in the EU (-65.6%). This mostly reflected less stringent lockdowns in several non-EU countries and domestic air services being less affected than international ones.

While passenger volumes on international routes decreased at a similar pace at non-EU and EU airports (respectively -65.1% and -65.4%), the decrease on domestic routes was less acute at non-EU airports (-50.7%) than at EU ones (-62.9%). That was the case in particular for airports in Russia, Norway and to a lesser extent Turkey.

AIRPORT RANKINGS HEAVILY DISRUPTED

All this resulted in significant changes in the ranking of the Majors1 (top 5 European airports).

During the month of June - which saw passenger traffic across the European airport network falling by -93.2% - Moscow-Domodedovo became the busiest European airport with 716,800 passengers (-73.3%). The Russian airport was followed by Paris-CDG (625,900 passengers, -90.9%), Moscow-Sheremetyevo (622,800 passengers, -86.5%), Frankfurt (599,200 passengers, -90.9%) and Istanbul (591,000 passengers, -90.1%).

London-Heathrow (-95.2%), which normally holds the top spot, came down to the 11th position, handling just over 350,700 passengers compared to 7.24 million in June last year. Amsterdam-Schiphol, the 3rd busiest European airport last year, came down to the 7th position (471,800 passengers, -92.7%).

Disruptions in rankings were not limited to the top 5 but widespread in the airport league – also reflecting the lack of alignment between European States in lifting travel restrictions. For example:

- Athens (-87.9%) and Izmir (-77.7%) welcomed more passengers than Munich (-95.1%);

- Sochi (-70.8%) more than Madrid (-96.5%) and Zurich (-93.1%);

- Bergen (-74.9%) more than Lisbon (-94.7%) and Copenhagen (-94.9%);

- Adana (-73.8%) and Tenerife (-80.6%) more than Dublin (-97.2%);

- Trondheim (-77.3%) and Catania (-91.1%) more than Brussels (-96.4%)

and Helsinki (-96%).

UK AIRPORTS TRAILING

June also saw UK airports significantly trailing their peers due to the overtly restrictive and untargeted travel restrictions enacted by the British Government. Apart from London-Heathrow, other UK airports coming down in the European ranking included:

- London-Gatwick (-99.4%) from the 10th position last year in June to the 92nd position;

- Manchester (-98.6%) from the 18th position to the 73rd position;

- London-Stansted (-97.8%) from the 24th position to the 59th position;

- Birmingham (-98.9%) from the 48th position to the 125th;

- Newcastle (-99.1%) from 93rd position to the 170th.

FREIGHT ALSO FALLING

Europe’s airports also experienced a -16% fall in freight traffic during the first half of the year, with the decline reaching -23.1% in the second Quarter.

The Top 10 European airports for freight traffic registered a decline of -13.7%, with only Luxembourg (+4.0%) posting an increase.

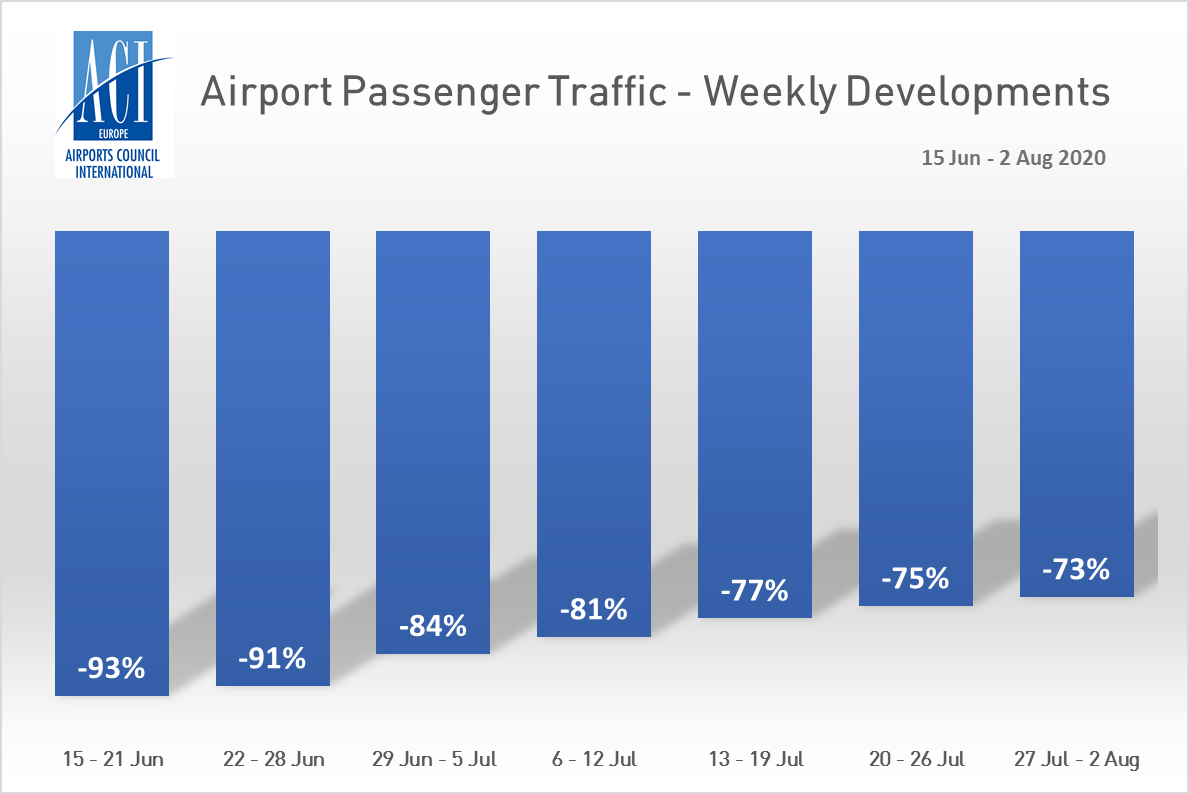

JULY & RECOVERY SLOWING DOWN

Following the tentative coordination of the lifting of travel restrictions at EU level as of mid-June, the traffic recovery has been slower than expected. As a result, passenger traffic across the European airport network still declined by -78% in July compared to the same month last year. This translated into an additional 208 million passengers lost, bringing the total passenger loss since the start of the year at 969 million.

Over the past 2 weeks the pace of the recovery has further slowed down. This is due to several States re-imposing travel restrictions, in particular the abrupt decision of the UK to require travellers from Spain to quarantine.

Olivier Jankovec, Director General of ACI EUROPE commented: “The recovery is far too slow-paced and uncertain. Despite desperate efforts to trim down their costs Europe’s airports are burning cash at the height of the Summer. Revenues are weak because of the combination of low volumes with rebates and incentives to airlines to attract and incentivise air traffic. Considering the seasonality of demand, this does not bode well for the coming months. If the recovery does not accelerate significantly, many airports will simply run out of money.”

H1 Lowest decreases per groups

During H1, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average decrease of -63.8%, -63.8%, -65.3% and -67.0%.2

The airports that reported the lowest decreases in passenger traffic are as follows:

GROUP 1: Moscow DME (-49.0%), Istanbul SAW (-54.8%), Moscow SVO (-58.3%), Oslo (-58.7%) and Istanbul IST (-59.9%)

GROUP 2: St Petersburg (-52.7%), Moscow VKO (-54.2%), Gran Canaria (-54.3%), Geneva (-57.7%) and Tenerife South (-57.9%)

GROUP 3: Sochi (-45.7%), Bergen (-52.3%), Minsk (-52.8%), Sofia (-53.1%) and Adana (-54.8%)

GROUP 4: Floro (-18.7%), Bronnoysund (-24.4%), Kristiansund (-27.5%), Leknes (-34.7%) and Sandnessjoen (-35.6%)

The 'ACI EUROPE Airport Traffic Report – June, Q2 & H1 2020’ includes more than 400 airports in total representing more than 90% of European air passenger traffic.