European airports report slower passenger growth & declining freight in 2019

13 February 2020- Slowest passenger traffic growth in 5 years reported during 2019, mainly due to stronger deceleration in the non-EU market, declining domestic traffic as well as airline bankruptcies & capacity restraint in the EU market.

- A record 2.43 billion passengers welcomed by Europe’s airports in 2019 & Passenger traffic still up by +32.3% since 2014. EU airports added +57.8 million passengers in 2019, accounting for 76% of the growth.

- The Majors (Top 5 European airports: +1.8%) and smaller regionals (+0.3%) underperformed the European average.

- Freight traffic at -1.9% in 2019, dragged down by EU airports.

Brussels - European airport trade association, ACI EUROPE today releases its traffic report for December, Q4, H2 and Full Year 2019. This is the only air traffic report that includes all types of airline passenger flights to, from and within Europe (full service, low cost, regional, charter and others).

Passenger traffic across the European airport network (46 countries) grew by +3.2% in 2019. While this is just over half the growth rate registered in 2018 (+6.1%) and the weakest performance in 5 years, it still resulted in Europe’s airports welcoming a record 2.43 billion passengers in 2019.

The passenger growth slowdown in 2019 was more significant at non-EU airports and largely driven by a decline in domestic traffic (-1.1%), as international traffic kept growing dynamically (+4.6%). It also reflected airline consolidation and limited airline capacity expansion, as aircraft movements only increased by +1.1% during the year and even became negative in the last Q4 (-1.2%). Meanwhile, freight traffic dropped by -1.9% in 2019, the worst performance since 2012.

Olivier Jankovec, Director General of ACI EUROPE said : “Over the past 5 years, Europe’s airports have increased their passenger traffic by more than +32% - meaning they have actually accommodated an extra 595 million passengers since 2014. But 2019 has been a pivotal year. Volumes were still up, but the deceleration has been notable on the back of both supply and demand pressures.”

Looking at the months ahead, Jankovec noted that many airports have planned for continued lower growth in passenger traffic in the face of uncertain trading conditions. He commented: “Some of the supply side pressures might start easing, especially if the 737 MAX is finally approved to fly again and if the recent decrease in oil prices is not reversed. However, there are for now few if any signals that airlines may be considering more capacity expansion – and further airline consolidation remains an ongoing reality.”

He added: “The immediate big question mark is what happens with the coronavirus outbreak. Europe’s airports have been coordinating closely with and assisting public health authorities in their containment efforts.The traffic impact so far has been marginal and mostly limited to those airports with direct air services to China. We estimate that in February, the top10 EU/UK airports1 will collectively lose 475.000 passengers to/from China, which should amount to just 1.2% of their total traffic for the month. But as wider economic consequences start kicking-in in China and potentially beyond, the impact on air traffic could become more widespread and significant for Europe’s airports.”

EU AIRPORTS GROWTH HIT BY AIRLINE BANKRUPTCIES & CAPACITY RESTRAINTS

EU airports saw passenger traffic increasing by +3.3% in 2019 (compared with +5.4% in 2018). This resulted in 57.8 million additional passengers over the previous year - the equivalent of the yearly traffic handled by Madrid-Barajas airport. The EU market accounted for 76% of the total passenger traffic growth in Europe in 2019.

The pace of growth halved as the year progressed (from +4.8% in Q1 to +1.9% in Q4) – although it somewhat rebounded in December (+3%). This mainly reflected the exposure of EU airports to airline bankruptcies as well as EU airlines generally limiting capacity growth and network expansion on the back of less favourable economic conditions and Brexit uncertainties.

Airports in Austria, Estonia, Latvia, Poland, Hungary, Croatia, Romania, Malta, Luxembourg and Portugal grew at more than twice the EU average. Airports in the UK, Germany, the Netherlands, Belgium, Denmark and Greece underperformed while those in Sweden, Bulgaria, Slovakia and Slovenia registered declines in passenger traffic.

Amongst capital & larger EU airports, the highest growth in passenger traffic came from Vienna (+17.1%), Milan-Malpensa (+16.6%2), Riga (+10.5%), Berlin-TXL (+10.1%), Luxembourg (+9.5%), Budapest (+8.8%), Tallinn (+8.6%), London-Luton (+8.1%), Lisbon (+7.4%), Madrid (+6.6%), Bucharest (+6.4%) and Warsaw (+6.2%).

NON-EU MARKET SHARPLY DECELERATING

Passenger traffic growth at non-EU airports stood at +3% in 2019 – a significant deceleration compared to the previous year (+8.3% in 2018). This resulted in non-EU airports only adding an additional 18.3 million passengers in 2019.

While airline bankruptcies (WOW) also affected the non-EU market, macro-economic conditions generally played a bigger role in shaping their fortunes – resulting in a significant impact on domestic passenger traffic (-3.6%). These factors explain the considerable variation in passenger traffic performance within the non-EU markets – from the impressive growth posted by airports in Ukraine (+22.3%) to the severe slump in Iceland (-26.1%). Amongst the largest markets, Russia grew above the non-EU average (+5.8%), while Turkish airports grew only marginally (+0.4%).

The best passenger traffic performance at capital & larger non-EU airports came from Kyiv-Boryspil (+21.1%), Tirana (+13.3%), Antalya (+12.8%), Minsk (+12.5%), Yerevan (+12.3%), Moscow-Vnukovo (+11.7%), Pristina (+9.6%), Skopje & Sarajevo (+9.3%) and Belgrade (+9.2%).

MAJORS & SMALLER REGIONAL AIRPORTS UNDERPERFORMING

Passenger traffic at the Majors (top 5 European airports) increased by +1.8% in 2019, down from +4.8% in the previous year.

Continued physical capacity constraints and airlines limiting expansion were the main factors containing their performance. Collectively, the Majors added 6.5 million passengers, with 60% of that incremental growth coming from Paris-CDG alone (+5.5% - 2nd position with 76.2 million passengers), followed by Frankfurt (+1.5% - 4th position with 70.5 million passengers), London-Heathrow (+1% - 1st position with 80.8 million passengers), Amsterdam-Schiphol (+0.9% - 3rd position with 71.7 million passengers) and Istanbul (+0.2% - 5th position with 68.5 million passengers3).

51% of smaller regional airports4 saw their traffic increasing, compared to 77% for the rest of the industry – reflecting once again the fragility of their markets.

However, many larger regional airports posted impressive gains in passenger traffic, including Krakow (+24.2%), Seville (+18.3%), Nantes (+16.7%), Dubrovnik (+14.1%), Bordeaux (+13.3%), Brest (+11.8%), Bologna (+10.6%), Bari (+10.2%), Porto (+9.8%), Valencia (+9.8%), Naples (+9.3%) and Marseille (+8.1%). These results account for the success of their route development strategies and the continued expansion of direct international air connectivity - including new long-haul services.

FREIGHT TRAFFIC DRAGGED DOWN BY THE EU MARKET – RECOVERY IN SIGHT?

Freight traffic remained negative all along 2019 with the exception of December (+0.5%), the first positive monthly since October 2018. EU airports dragged the performance down in 2019 at -3.2% (and still negative in December at -0.7%) while non-EU airports remained mostly positive at +1.9% (increasing to +7.6% in December).

These results point to the freight downturn finally bottoming out and possibly moving towards a recovery as trade tensions are finally easing and the global economy is expected to pick up in 2020 - subject to the Coronavirus being effectively contained.

Out of the top 10 European airports for freight traffic, only Liège (+3.5%) and Madrid (+7.7%) posted increases. Apart from these, the highest increases came from Lisbon (+14.1%), Zaragoza (+9.5%) and Helsinki (+8.4%).

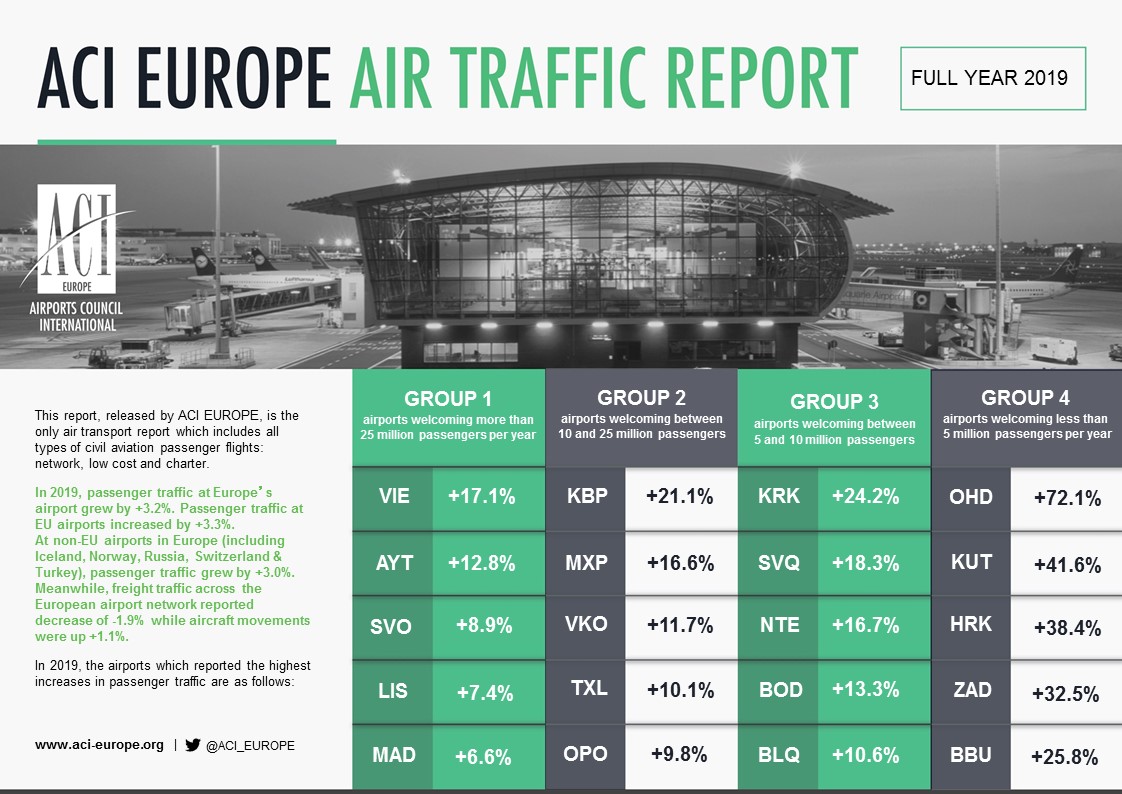

TRAFFIC CATEGORIES & HIGHEST INCREASES 2019

During the full year of 2019, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment of +3.0%, +4.8%, +3.0% and +1.6%.

The airports which reported the highest increases in passenger traffic during 2019 (compared with 2018) are as follows:

GROUP 1: Vienna (+17.1%), Antalya (+12.8%), Moscow SVO (+8.9%), Lisbon (+7.4%) and Madrid (+6.6%)

GROUP 2: Kyiv KBP (+21.1%), Milan MXP (+16.6%), Moscow VKO (+11.7%), Berlin TXL (+10.1%) and Porto (+9.8%)

GROUP 3: Krakow (+24.2%), Sevilla (+18.3%), Nantes (+16.7%), Bordeaux (+13.3%) and Bologna (+10.6%)

GROUP 4: Ohrid (+72.1%), Kutaisi (+41.6%), Kharkiv (+38.4%), Zadar (+32.5%) and Bucharest (+25.8%)

During the month of December, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment of +2.2%, +3.2%, +5.0% and +2.7%.

The airports which reported the highest increases in passenger traffic during December 2019 (compared with December 2018) are as follows:

GROUP 1: Vienna (+11.6%), Lisbon (+10.5%), Moscow DME (+8.1%), Istanbul SAW (+7.3%) and London LGW & Madrid (+6.7%)

GROUP 2: Budapest (+18%), Tel-Aviv (+15.1%), Milan BGY (+14.4%), Kyiv KBP (+12.6%) and Warsaw WAW (+11.7%)

GROUP 3: Krakow (+27.6%), Bordeaux (+17%), Malta (+14.7%), Belgrade (+14.1%) and Sochi (+13.4%)

GROUP 4: Ohrid (+116.1%), Zakynthos Island (+76.4%), Dubrovnik (+49.9%), Nis (+47.6%) and Kharkiv (+45.9%)

1London-Heathrow, Paris-CDG, Amsterdam-Schiphol, Frankfurt, Madrid-Adolfo Suarez, Barcelona, Munich, London-Gatwick, Rome-Fiumicino, and Dublin.

2Part of Milan-Malpensa’s growth resulted from transferred traffic from Milan-Linate airport during its 3-months closure for runway maintenance work.

3The figures reported for Istanbul airport include the traffic handled by Istanbul-Ataturk airport between January-April 2019 and the traffic handled by the new Istanbul airport thereafter.

4Regional airports handling less than 5 million passengers per annum.